If you’re currently struggling with $10,000+ in high-interest debt like credit card debt, it can feel impossible to get ahead financially.

However, you don’t have to tackle the debt-free journey alone.

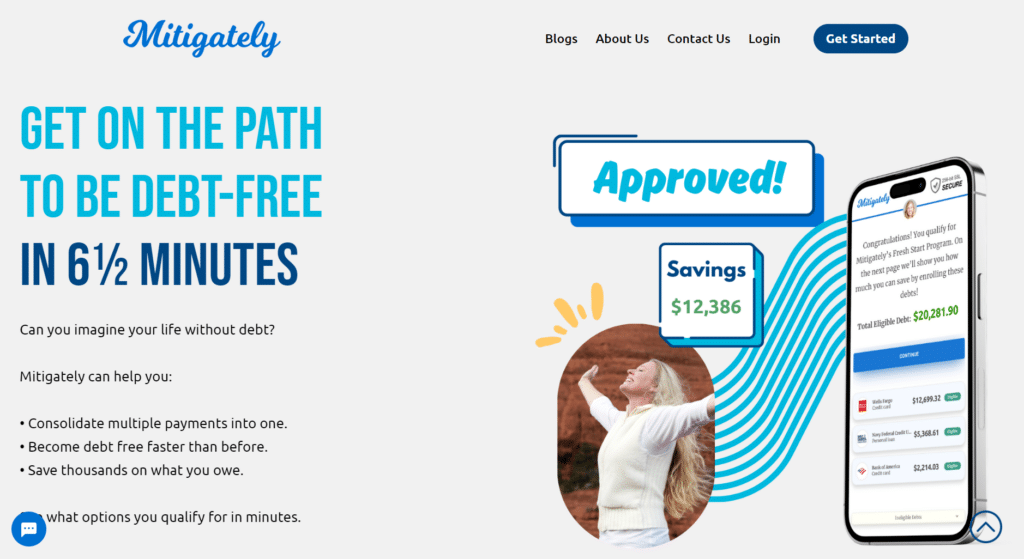

Instead, you could work with one of America’s top debt relief company – Mitigately – to help put your credit card debt behind you.

Mitigately helps families consolidate their painful high-interest debts into a single payment with much lower interest rates. In the long run, this is how people become debt free fast while saving thousands in the long run.

The best part? You can get started just by answering a few simple questions in about 5 minutes. You don't have to spend hours on the phone like you do with a lot of other companies either to get matched to the best debt relief option for you.

Mitigately doesn't charge any service fees until your debt is settled. And on average, people save 35% of their total debt by working with them!

It only takes a few minutes to check what your options are. Checking is free too, and in some cases, Mitigately is helping people become debt free in 12 to 36 months.

GET STARTED →There Are Other Options To Become Debt Free Too

We think Mitigately is one of the best debt relief companies in the country. And its track record speaks for itself.

However, it's not your only option to tackle debt quickly.

In fact, there are several clever financial tactics, tips, and resources you can turn to to get help. Some of our favorites include:

Using cash advance apps like EarnIn to borrow up to $750 money against an upcoming paycheck.

Earning free PayPal cash by playing games with companies like Kashkick.

Selling stuff you don't use anymore, like electronics, jewelry, clothing, and other household items (you can use Worthy to sell any jewelry and watches!)

Answering surveys for money in your spare time with sites like Survey Junkie.

The point is, there are tons of ways to boost your monthly income quickly. You can then use that extra side dough to pay down your debt even faster!

BONUS OFFER: Boost Your Monthly Income By $430 With This Super App!

How does an extra $430 in your pocket each month sound?

This kind of cash can probably go a long way in helping you pay bills. And that's why we definitely recommend checking out an app called Super.

With Super, members can earn around $430 in extra cash per month by answering surveys, playing fun games, and completing easy online tasks in their spare time.

But that's not all…Super also lets its members access cash advances of up to $250 against an upcoming paycheck. And the best part is you don't pay any interest or hidden fees since you're just accessing money from your paycheck a little bit earlier.

On top of that, Super has hundreds of cash-back deals and coupons to help you save when you shop online. And it's also known for industry-leading travel deals that can slash the prices of hotel stays and flights.

Overall, think of Super as a way to supercharge your finances. You can earn and save more money each month with its features, and we love its cash advance feature the most since it can help you make ends meet between payday.

19 Legit Ways To Make Extra Cash This Week.

7 Clever Methods To Pay Down Debt Even With $0.

EarnIn Disclaimers:

1: EarnIn is a financial technology company, not a bank. EarnIn services may not be available in all states. Bank products are issued by Evolve Bank & Trust, Member FDIC.

2: Subject to your available earnings, Daily Max and Pay Period Max. Restrictions and/or third party fees may apply, see EarnIn.com/TOS for details.

3: EarnIn does not charge interest on Cash Outs. EarnIn does not charge membership fees for use of its services. Restrictions and/or third party fees may apply, see EarnIn.com/TOS for details.

4: Fees apply to use Lightning Speed. Lightning Speed may not be available to all Community Members. Cash Outs may take up to thirty minutes, actual transfer speeds will depend on your bank. Restrictions and/or third party fees may apply, see Cash Out User Agreement for details.